Divorce alimony, also known as maintenance, is court-granted financial support to a spouse unable to maintain themselves after a legal separation or divorce. In the Indian legal system, alimony aims to ensure that the financially dependent spouse, usually the wife, can sustain a similar standard of living to what they were accustomed to during the marriage. While traditionally alimony was awarded to wives, Indian courts have increasingly recognised the rights of husbands to claim maintenance if they are financially dependent.

Divorce Alimony: What You Need to Know

The spouse seeking alimony needs to file a petition before the court. They must provide evidence of their financial condition and the financial capabilities of the other spouse. The court may call both spouses to present evidence and arguments before deciding on the alimony amount.

Legal Basis

Alimony is primarily granted under Section 25 of the Hindu Marriage Act 1955. This section empowers the court to order either the husband or wife to provide financial support to the other if they do not have sufficient means to support themselves. It applies to Hindus, Buddhists, Jains, and Sikhs. Similar provisions exist in other personal laws in India:

- The Muslim Personal Law, governed by Islamic principles, including the Muslim Women (Protection of Rights on Divorce) Act, 1986.

- The Christian Marriage Act, 1872, applies to Christians.

- The Parsi Marriage and Divorce Act, 1936, applies to Parsis.

- The Special Marriage Act, 1954, applies to inter-religious marriages or those opting for a secular marriage.

- The Family Courts Act of 1984, established family courts that decide on maintenance and alimony cases.

The Code of Criminal Procedure (CrPC), Section 125 provides maintenance to wives, children, and parents, regardless of religion.

Types of Alimony

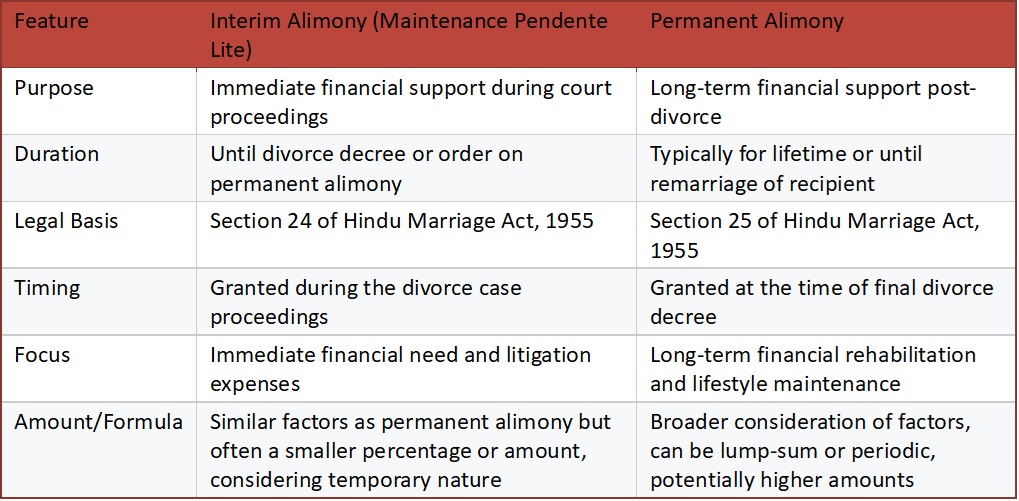

Indian law recognises two main types of alimony.

Interim Maintenance (Pendente lite): This is temporary alimony granted during the court proceedings of a divorce case. It ensures the financially dependent spouse can maintain themselves during the ongoing divorce.

Permanent Alimony: This alimony is granted after the divorce proceedings. It can be a lump-sum payment or periodic payments (monthly or quarterly). The aim is to provide long-term financial support to the spouse who needs it.

Modes of Payment

Alimony can be awarded as:

Periodic Payment: Paid regularly, such as monthly or quarterly. This income is considered revenue for the recipient and is taxable, while the payer cannot claim deductions.

Lump-sum Payment (One-time Payment): A single, consolidated payment made at the time of divorce settlement. This is considered a capital receipt and is generally tax-free for the recipient, and non-refundable by the payer.

There is no strict formula for calculating alimony in India. The courts have discretion and consider various factors to determine a “just and proper” amount. However, the Supreme Court of India has suggested that in cases of periodic payments, 25% of the husband’s net monthly income can be considered a benchmark. For lump-sum payments, amounts can range from 1/5th to 1/3rd of the husband’s net worth, but this is not a fixed rule.

There is an alimony called reimbursement alimony, where one party spends money on the spouse for various reasons like education, employment programmes, etc. This amount is reimbursed at the time of the divorce.

During our divorce settlement, my ex-wife asked for a one-time payment to be completed within one year of the divorce. Her parents had helped with the maintenance of our house and a few other expenses. I did not feel her request was unjust. We are both working and I have a few dependencies. So, she did not ask for a periodic alimony payment.

Ajay, Visual Designer, Mumbai

Duration of Alimony

Typically, permanent alimony is intended to support the dependent spouse for their lifetime, or until remarriage, especially for wives. If a wife remarries, the alimony obligation usually ceases, and the husband can petition the court to stop alimony payments. Interim alimony, as mentioned, is applicable only during the divorce proceedings.

Factors Determining Alimony Payments

Indian courts consider a wide range of factors to decide the alimony amount. These factors ensure that the alimony awarded is fair and equitable, considering the circumstances of both spouses.

- The court assesses the current income, assets, and liabilities of the husband and wife. This includes salaries, property ownership, investments, and other sources of income. If the wife is working but earns significantly less than the husband, she may still be eligible for alimony to maintain a comparable living standard.

- The court considers the educational qualifications, skills, and employability of both spouses to determine their potential to earn independently in the future. For a non-earning spouse, the court may assess their age, education, and ability to acquire skills for future employment.

- The lifestyle and social status the couple maintained during their marriage is a significant factor. The alimony aims to ensure, as much as possible, that the dependent spouse can maintain a similar lifestyle post-divorce.

- Longer marriages often result in higher alimony amounts and longer durations of payment. Marriages lasting over 10 years may be considered for lifelong alimony.

- The age and health conditions of both spouses are taken into account. If a spouse is elderly or has health issues that prevent them from earning, this can increase the alimony amount and duration.

- The court may consider the conduct of both parties during the marriage. For instance, if one spouse has been abusive or unfaithful, it could influence the alimony decision, although financial need remains the primary consideration. In cases of fault-based divorce (e.g., adultery, cruelty), the guilty party may be required to pay higher alimony.

- The court considers the liabilities and responsibilities of both spouses, such as dependent parents, children (although child support is separate from alimony), and any significant debts or obligations. The court may factor in the responsibilities of the parent who is awarded custody. Alimony could be impacted by the ability of the custodial parent to work and support themselves.

- The direct and indirect contributions of each spouse to the marital life are evaluated. This can include homemaking, raising children, and supporting the other spouse’s career, which are often considered the wife’s contributions.

- Courts may also consider current inflation rates and the cost of living to ensure the alimony amount is sufficient over time. Courts consider mandatory deductions like income tax, EMIs, and loan repayments to calculate the net income of the spouse who may be required to pay alimony.

Conclusion

Alimony in India is determined on a case-by-case basis, with courts aiming to balance the financial needs of the dependent spouse with the payer’s ability to provide support. They increasingly favour lump-sum settlements to avoid prolonged litigation. There is a growing emphasis on ensuring that alimony enables the recipient to maintain a reasonable standard of living without creating undue financial burden on the payer.

Alimony orders can be modified if there is a significant change in circumstances, such as loss of employment, remarriage, or improved financial status of the recipient. If the paying spouse fails to comply with the court’s alimony order, the recipient can file for enforcement, which may include garnishing wages or attaching property. Legal advice is crucial to navigate the complexities of alimony claims and ensure fair outcomes.

Navigating Life After Divorce or Separation?

Understanding alimony is just one step in the journey. If you’re seeking support, connection, or even a fresh start, our app is here to help. We specialise in providing a safe and understanding space for divorced, separated, and widowed individuals, offering resources, blogs, and personalised psychometric matchmaking. Our unique process ensures you are connected with like-minded individuals who share your life goals and values.

Join us today and take the first step towards building a fulfilling future.

References

Anushka. “Things To Know About Alimony.” GetLegal India. https://getlegalindia.com/alimony/.

Mahawar, Sneha. “All you need to know about divorce alimony.” iPleaders. August 11, 2023. https://blog.ipleaders.in/all-you-need-to-know-about-divorce-alimony/, accessed February 12, 2025.

Vakilsearch. “Divorce Alimony Laws: Types, Eligibility, Tax Implications.” Vakilsearch. https://vakilsearch.com/divorce-alimony-laws-India.